The age old question remains- “How should I invest my money?”

To answer this question you must first have realistic expectations and determine whether your investment is for the short or long term.

Knowing the type of investment strategy you want to use will help you get your priorities in order.

If you are looking for a short term profit strategy with the high possibility of losing your investment, this article is not for you.

This article was created for the vast majority of investors who wish to make a reasonable rate of return without the high risk associated with typical investing.

If you have realistic expectations and want to earn a reasonable rate of return, then keep reading.

Let’s first begin with a few basic facts and not opinions. In a world where everyone has opinions, with very little factual information to back them up, facts matter.

Facts

Real estate is the only investment that doubles nearly every ten years.

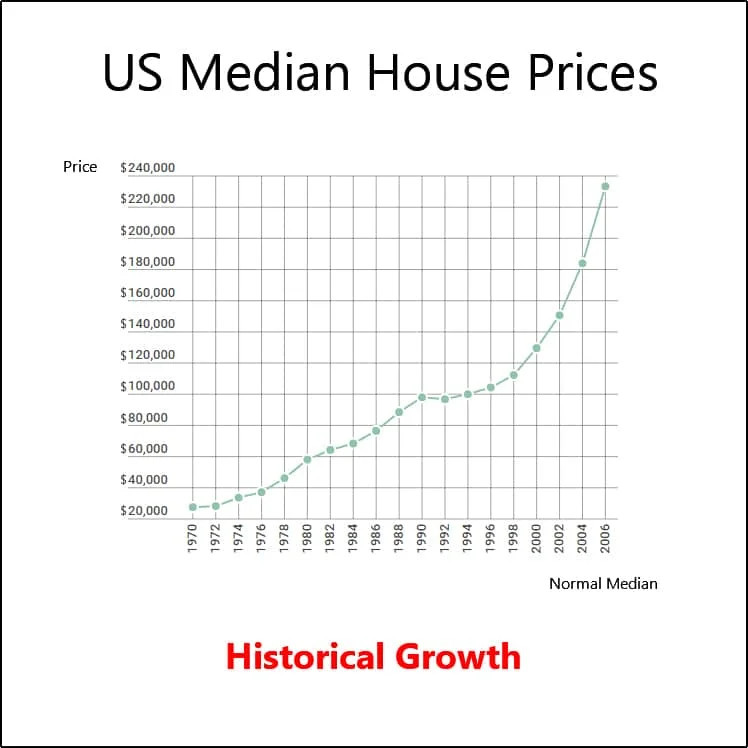

As you can see in the chart above, real estate values increase upwards of 100% every ten years.

As you can see in the ten year period beginning in 1970 to 1980 property values have increased from an average of $21,000 to more than $55,000 by 1980. That’s nearly a 300% increase in property value in only 10 years.

The next ten years were no different. Growth levels continued to skyrocket. Property values increased from an average of $55,000 by the end of 80’s to a little over $91,000 by 1990. Again, this scenario demonstrates the growth potential of real estate.

This level of growth is not an outlier or some fact pulled out of a random hat. This is the growth of real estate over a 20 year period.

Need more proof? Well here it is.

In the next ten years (1990-2000) the average price of real estate increased by another 45%.

In what world is this level of consistent growth possible? Only in real estate.

Let’s not forget to mention that during the same period the property owner increased their investment, they were also able to live in the home and/or collect rental income during this period.

There is no investment other than real estate which allows the investor to simultaneously increase their net worth, while also giving them the ability to collect rental income.

Compare this to buying a stock. What’s the difference?

Aside from potentially losing one’s investment, the stock holder would not be collecting rental income and would also not be able to live in the property themselves.

Let’s further explore the comparison between buying stock and owning real estate.

Using the historic growth chart, you can see that if an investor bought a property for $100,000, their average expected property would be 100% more expensive in ten years. This is equivalent to double the price during that period. Using this example, within 10 years, one’s investment of $100,000 would turn into $200,000, while at the same time they could live in the property or collect rental income.

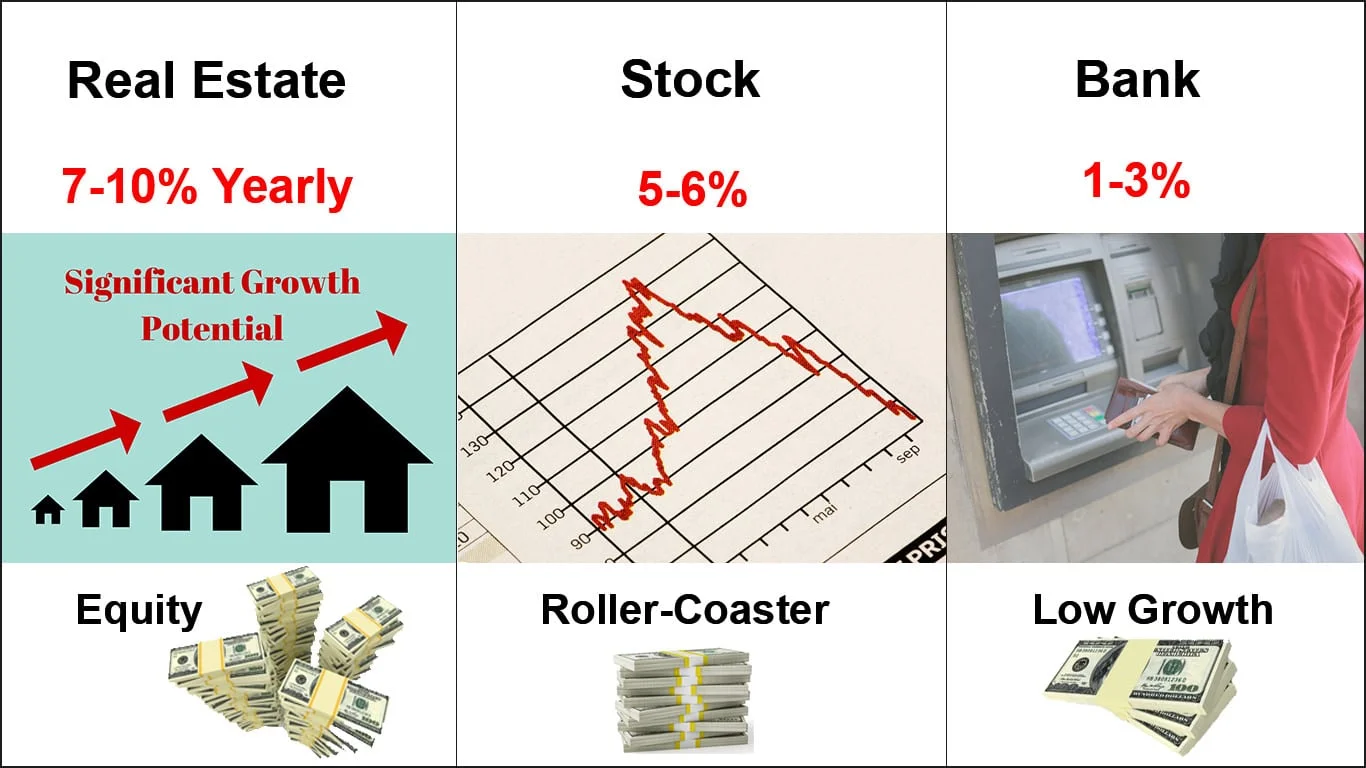

Now let’s look at owning stock. Historically, stock prices increase 5-7% annually and 50-70% over a ten year period. However as we have all know, many stock companies go out of business, get bought out, or were significantly overvalued when first purchased.

So now we know the average growth potential has historically been higher in real estate than in the stock market.

It’s also worth mentioning again that in addition to the fact that property values increase at a greater rate than stock, property is also tangible and therefore can be used by the owner and/or be rented out to tenants.

Stock can only be traded.

The stock market is greatly affected by other sectors of the economy and thus is subject to periods of significant turbulence.

Although real estate also has periods of uncertainty, prices will always climb in the long term, unless the location is experiencing massive migration such as that from a farm town.

Let’s not forget to mention the fact than when property values decrease, rent typically increases. How can this be?

Because when values go down, it’s typically reflective of a slow economy and therefore many consumers would not have the money or credit to buy a house. If they do not have the money or credit to buy a house they are forced to become renters and this causes more demand in the rental market, which means renting property becomes more expensive.

Who does the benefit? It benefits the property owner.

This means that even in brief periods of real estate value decline, the property owner would be likely able to increase their rental income.

Even in brief periods of decline, the decline was temporary and short lived. Ultimately, even if values decreased temporarily this would not matter in the long run because the property investor would still be collecting rental income.

How can this be?

Let’s first mention that real estate is the only item, real or intangible, that is used by every consumer. Think about it for a minute. Every person lives somewhere-whether they rent or buy, in addition to the fact that companies must purchase or lease real estate for their businesses.

Real estate truly is the only industry that affects everyone.

Although real estate has periods of decline, over the long term it is nearly impossible for values to decline.

How is this possible you may ask?

Property values must always increase overtime due to a variety of factors including:

- Population growth

- Inflation

- Less available property which creates more demand

Population Growth

As the population continues to grow so too does the need for real estate. With only a limited amount of land and an ever growing population, the price for land must rise.

As the law of supply and demand states, when there is more demand for the same consuming product, prices go up.

Who does this benefit? This benefits real estate investors who can take advantage of higher prices and higher rental income, helping them make more money.

Unless the property was purchased in a rural part of Mississippi, or an otherwise declining town where residents are fleeing the city, property values will continue to rise to compensate for the growing population.

How can investors take advantage of this trend?

One of the best places to invest in real estate is cities or neighborhoods where population growth is occurring.

Need an example of how population growth in a major metropolitan city affected property prices, look below and you will find two examples of neighborhoods in Los Angeles and Texas that were heavily influenced by population growth.

Downtown Los Angeles

Once considered only a place to work, Downtown Los Angeles has seen significant growth in the real estate market.

In the year 2000 the Census Bureau estimated that Downtown’s population was a mere 27,000. By the end of 2015, the population boomed to well over double that amount, reaching nearly 60,000 people.

During this same period Downtown Los Angeles experienced population growth, property values increased upwards of 2-4 times the original value. Such an example is not an outlier. In fact, examples of this can be seen all throughout the country.

According to a prominent real estate owner of large downtown buildings, who wishes to remain anonymous, his “profits increased significantly during the last ten years” as downtown experienced significant population growth and subsequent increase in real estate activity.

In the real estate owner’s own words, “I bought an old rundown building near the Staples Center for nearly $10 million, and currently the value of the property is estimated at over $150 million.” Such an increase in value, although not typical, is not something that rarely occurs in real estate.

The investor goes on to say, “the more people that move into the neighborhoods I own property, the more money I make, and the higher my net-worth becomes.”

To further illustrate this point, I’ll introduce another state that can help explain the growth potential of real estate in markets with population growth.

Texas

Demand for real estate in Texas has grown substantially over the past few years. In fact, Texas experienced more economic growth in the country, partially due to more economic activity that can be evidenced through massive migrations to the state.

In 2014 alone, 584,000 people moved to Texas from other parts of the country. What was the result of all this massive migration?

The rapid growth in the population led to increased economic growth, job opportunities, all of which led to a rapidly growing real estate market.

In fact the relocation of residents helped the real estate market improve by an average of 10.5% in the four major metropolitan cities. This growth occurred only in one year. Such growth is nearly double the national average.

Just to nail the coffin in the nail with this argument, we must also mention that the increased population raised household incomes by 9.6%, which again is nearly double the national average.

How does this impact the real estate market you may ask? Well, for one, the more money in the hands of consumers, the higher prices will go as consumers have more to pay, which increases growth in the real estate market.

In addition to increases in the value of property, rental prices go up as well, thereby increasing the rate of return investors can expect to make on their investments.

Imagine the power of this scenario. Rather than risking one’s money in the stock market with the potential of making much less, real estate investors saw their investments rise ten percent in one year, in addition the fact that during this period they were collecting rental income.

Such an example does not exist in the stock market. Not only is the stock market much more risky and has less profit potential in the long term, but owners of stock do not get the added benefit of creating consistent monthly income.

Additionally, real estate compromises 60 percent of the worlds assets. When real estate is the most in demand product in the history of the world, it is not difficult to see why property values continually rise over the long term.

Yes of course stock owners can expect their monthly net worth to grow with the purchase of the right stocks, but at what costs?

Well for one, even if the stock is growing, the stock owner can only expect returns when they sell the stock.

This is not the case with real estate. In real estate, one’s income begins coming through the door as soon as they begin renting the property, all while continuing to increase their equity as the market grows through an increased property value.

Unlike stocks whose performance is dependent on the performance of the company, the growth of real estate is not affected by the performance of an individual or company.

Inflation

As the government continues to print more money, property values will go up.

Why is this you may ask?

Property values are forced to go higher when there is more money chasing the same amount of land.

We have seen this pattern play out historically. Let’s look at the last time this began happening which was in the year 2009.

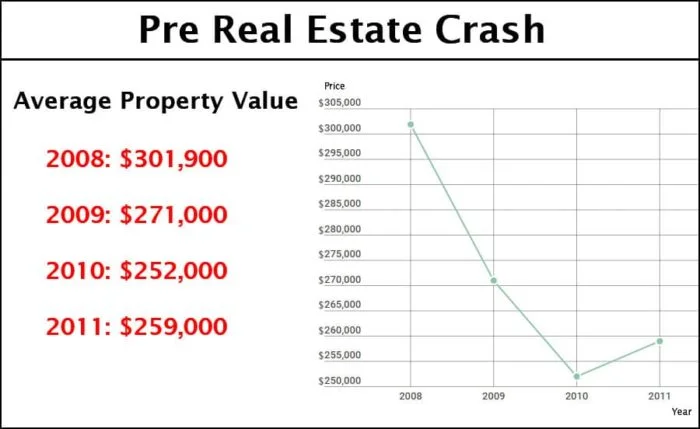

The year 2008 marked the worst recession the United State’s had experienced since the Jimmy Carter era.

To help combat the potential for more economic calamity, the Fed began pumping more money into the economy.

How did the Federal Reserve’s monetary policy of printing more money increase property values?

Property values started to rebound and go higher. Since the end of 2011 and beginning in 2012 property prices began going higher and have continued rising for the past four years.

Although property prices are subject to change and are more complicated than any one single outside force (including interest rates and economic growth), inflation plays a natural course in the growth in the real estate market.

Inflation is a natural part of the economy and will always occur as the population continues to increase. This occurs because governments are forced to print more money to compensate for the increased population.

Inflation example

Imagine a country that only has 100 homes and a money supply of $200. Assuming no other goods are a part of the economy, the cost of each home would be $2. If the government increases the monetary value of the economy to $600, the price per home would $6.

Of course the above example is a simplistic explanation, however using the example it is easy to understand why property values would increase as the money supply increases.

A simple way to put sum up the impact of inflation with relation to real estate values is the more money in the economy the higher the average price of real estate.

Clearly property values are affected by a host of other reasons including interest rates, property availability, stock market crash, and other factors; however it is easy to see the direct correlation between inflation and real property values.

Less Available Property

When the availability of property decreases in a given neighborhood, city, or state, property values are forced to rise.

This goes back to the concept of supply and demand. The more demand, the higher the prices. The less demand the lower the prices.

Well in the context of real estate, the land in the United State’s is never going to increase. Ultimately this forces prices to go up because the same dollars are chasing fewer inventory.

As land becomes scarcer and less available, landowners become wealthier. Because land becomes scarcer by the day as the population grows, property values must go up in the long term.

Benefits of Property Ownership

- Equity and Rental Income: Real estate is the only investment that increases in value, while simultaneously giving the owner the ability to collect rental income.

- Tangible: Real estate is the only investment that is tangible and will retain its value in the long term

- Growth Potential: Real estate is one of the few investments that can be purchased and subsequently remodeled and increase in value substantially within a few months

- Collateral: Real estate is one of the only investments whereby a lender would issue a loan based on the equity of the asset.

I will explain all of the above benefits in more detail for you to understand below.

Equity and Rental Income

Real estate is the only investment that gives owners two distinct money making benefits.

Although there are many more benefits of owning real estate, the main advantage over other investments include:

- The Ability to Increase One’s Equity.

- Collecting Rental Income

Unlike other investments whereby the investment grows through increased growth, real estate ownership gives investors the ability to collect rental income and increase one’s net work through more equity.

Imagine the following scenario: You buy a home for $300,000 and within 4 years its value increases to $425,000.

During this period the owner increased their net worth by $125,000, which is far more money than can safely and consistently be made with stocks, while all the same time, the owner would be able to collect rental income.

Lets suppose for a moment, the property owner rented the property for $1,275 during the 48 month period of ownership. Within the 4 year period, the owner will have collected $61,200.

During this period they also increased their net worth by $125,000. Within a 4 year period the property owner will have increased his net worth by $186,000. That’s well over a 60 percent increase in four short years.

Such an increase is rarely possible when buying stocks, bonds, or other risky assets that have the high potential to plummet.

Growth Potential

Real estate gives owners the ability to make money even after their investment is already fruitful.

How can this be?

Because property values and rental prices are dependent on the condition, style, and size of the property, property owners can increase their property income by remodeling or making additions to the property.

The best, if not, one of the best ways to increase a properties value is to increase its square footage.

Let’s look at the following real world example of a property purchased by a real estate investor in Los Angeles:

The investor purchased an old rundown property for $300,000. When purchased the property was only 2,400 square feet.

The investor wanted to increase the value of the property and decided to remodel the property, while also adding additional square footage.

The general rule in real estate is that property values are priced based on the square footage of the property. Each neighborhood has an average price per square foot.

To find the value of real estate, the average square footage is multiplied by the square foot of the subject property and there you have the estimated property value.

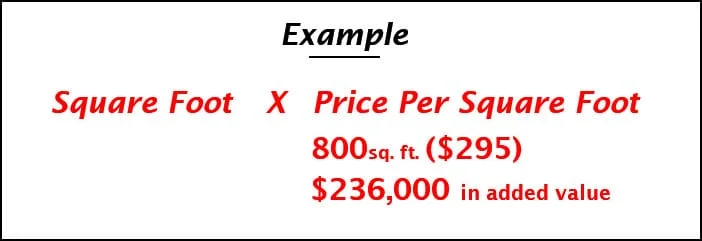

The investor added 800 square feet to the house. Each square foot in the neighborhood is worth $295.

By adding 800 square feet, the property owner increased the value by $236,000.

How was this calculated? You multiply the square footage by the cost per square feet and you get the total value.

Wow!!! There you have it. Within a 4 month period of applying for permit and constructing the property, the property owner increased their net worth by over $236,000 in less than 120 days.

Tell me again, what other investment has this potential. If you don’t know the answer it is because it does not exist.

Tangible

Real estate is one of the few assets that is tangible.

Novice investors may not know the importance of a tangible investment so I will explain that here.

When the economy begins to crater and many people can no longer afford their homes, the foreclosed property owners become renters thereby creating more demand in the rental market.

Such demand tends to increase the cost of renting because there are more people competing for the same amount of available units.

The need for tangible assets increases and therefore this directly benefits property owners.

Because land is tangible it will never lose its value. Although the value may decrease temporarily, it will rebound in the future.

Look at the historic charts below and you will see every time property values decreased, they eventually increased above recessionary levels.

In the case of stocks, when the stock value decreases, the stock will likely never recover.

Why do stocks not recover as well as real estate? There are two main reasons for this.

The first reason is because when the stock market collapses many investors get scared which causes a fire sale.

A fire sale has a few definitions, but for the purpose of this article, we will assume a fire sale is when the market drops, investors get scared and sale their stock creating more panic to other investors, causing them to sell as well.

This ultimately leads to an almost certain permanent decline.

The second reason real estate recovers better in a declining market over stocks is because stocks are not tangible. Intangible items generally do not hold as much value as necessary items.

Because real estate is a necessity as people need a place to live, even in a declining market, there will always be demand for rental units, unlike stocks which are seen as more of a luxury item.

To put it in simpler terms, in a bad market, consumers will continue renting units, however will likely not stay in the stock market.

If people leave the stock market what does this do to investors?

It will create panic and further decrease the value of stock holder’s stock value.

Collateral

Real estate is one of the few investments that can be used as collateral for retaining a loan.

Unlike stocks, bonds, or other similar investments that have significant risk, real estate is a real tangible asset that lenders would consider to offer financing based on.

Why is this the case?

Lenders do not provide financing for stocks, bonds, and other similar investments because of the potential for great loss. Lenders recognize that real property, one which can be compared to comparable properties, is a solid and safe collateral that they can issue financing on.

The fact that lenders provide financing on real estate is a great benefit because investors can cash out on the property and retain ownership. This is not the case with other investments.

This means a real estate owner can continue to collect rental income on their properties even after they have cashed out a portion of their investment.